Resource Library

All Featured

Why the Smallest Step in Your Process Creates the Biggest Risk

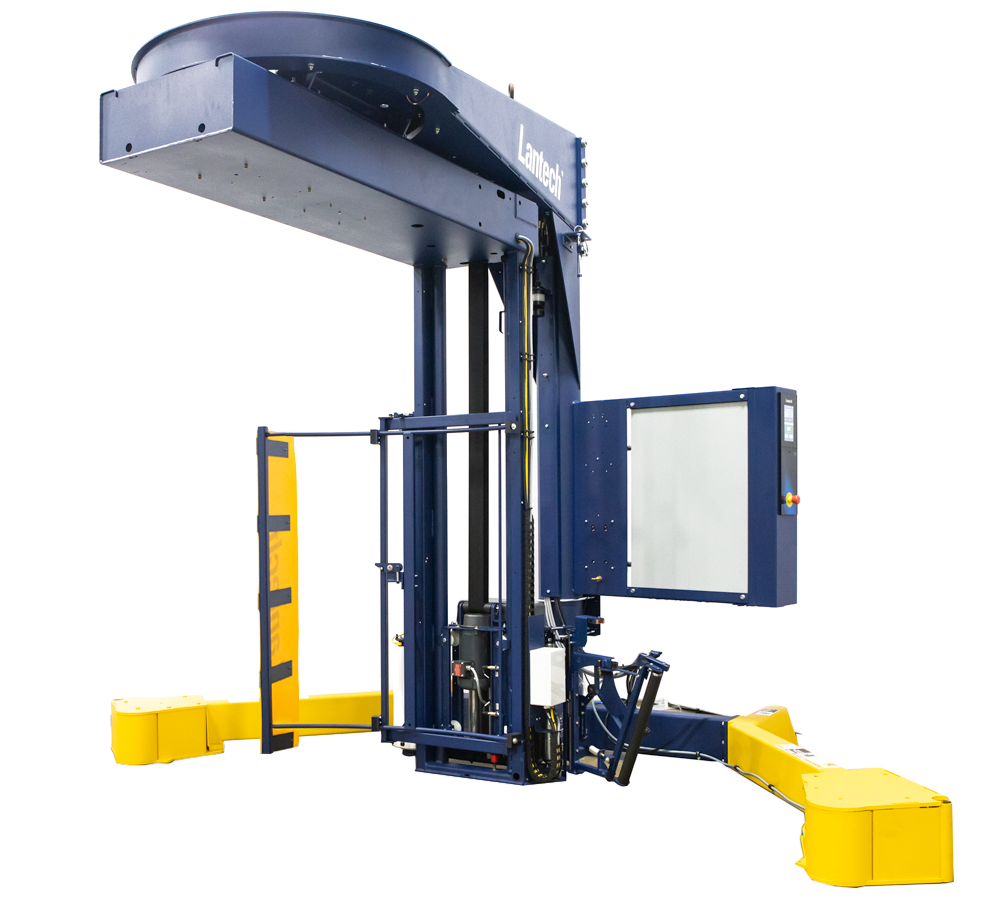

In many warehouse and manufacturing environments, stretch wrapping is treated as a […]

Learn MoreLantech Launches AMR-Integrated Stretch Wrapping Solutions and Introduces SL400 and SL400LT for Sale

FOR IMMEDIATE RELEASE LOUISVILLE, KY – February 2, 2026 — Lantech, the […]

Learn MoreSigns That Your Production Needs Case Erectors and Case Sealers

Automation of packaging processes is the key to scaling production without losing […]

Learn MoreHow to Choose a Case Erector for Your Packaging Line

Choosing a case erector is a critical decision for companies seeking to […]

Learn MorePackaging Automation Benefits: Efficiency, Cost Savings & ROI Explained

In today’s manufacturing environment, efficiency is a key challenge for businesses of […]

Learn MoreEnd-of-Line Packaging Automation: Where It Fits & Why It Matters

Automation has become a defining part of modern manufacturing and distribution. For […]

Learn MoreUser-Friendly Stretch Wrappers: Designed for Real-World Operators

In theory, every stretch wrapper operator is fully trained, follows best practices, […]

Learn MoreTop e-Commerce Packaging Automation Solutions That Improve Speed, Reduce Labor, and Control Costs

E-commerce fulfillment operations are under constant pressure. Order volumes continue to rise, […]

Learn MoreMost popular resources

Latest News

Lantech Launches AMR-Integrated Stretch Wrapping Solutions and Introduces SL400 and SL400LT for Sale

FOR IMMEDIATE RELEASE LOUISVILLE, KY – February 2, 2026 — Lantech, the […]

Learn MoreLantech Expands Louisville Manufacturing to Include CS300 and CS1000 Case Sealers

Louisville, KY – November 4, 2025 – Lantech, a global leader in […]

Learn MoreLantech Introduces the Next‑Generation Semi‑Automatic Stretch Wrappers – SL400 and SL400LT

Louisville, KY – September 29, 2025 – Lantech, a global leader in […]

Learn MoreStill Setting the Standard: Lantech Unveils Cutting-Edge Packaging Innovations at Drinktec and PackExpo

Louisville, KY – Lantech, a trailblazer in the packaging industry, is thrilled […]

Learn MoreGuides

4 Ways to Impact Sustainability with Film Optimization

Stretch film optimization is the fastest, lowest-risk way to reduce plastic today. In this guide, we highlight a few ways you can use film optimization to impact your sustainability efforts.

Read MoreTray Erector Buying Guide

A seamless packaging process is of invaluable value to companies striving for efficiency, speed, and consistency in their production. A tray erector can have a significant impact on your operational success.

Read MoreStop the Bleeding In the Paper-Based FMCG Industry’s Supply Chain

Reductions in primary and secondary packaging materials and ever-present cost reduction pressures are making most products more difficult to wrap. Fragile or delicate products like paper-based, fast-moving consumer goods (FMCG) are especially hard to wrap effectively.

Read MoreStretch Film Alternatives White Paper

Download this white paper to learn more about our evaluation into every currently stretch wrap alternative.

Read MoreCharts, Checklists And Calculators

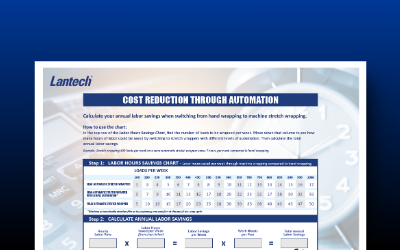

Calculator: Cost Reduction Through Automation

Calculate your annual labor savings when switching from hand wrapping to machine stretch wrapping.

DownloadCalculator: Automatic Case Erector Savings

Calculate your potential annual savings when switching from hand-erecting cases to automatic case erecting.

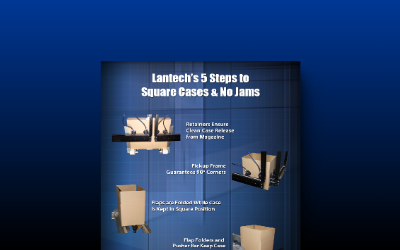

DownloadChart: 5 Signs of a Square Case

Learn five signs of a perfectly square case with this chart and let it serve as a reminder for the importance of square cases in pallet loading.

DownloadChart: Why Square Cases are Important

Find out why square cases are so hard to come by and how to identify one so you don’t have to take avoidable risks.

DownloadCalculator: The Power of Simple Automation

How much time and money are you wasting? Our calculator estimates the amount of labor cost you can eliminate from your stretch wrapping process with Simple Automation.

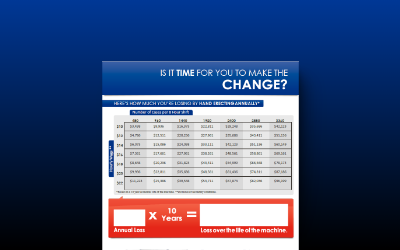

DownloadChart: Annual Loss From LTL Reweigh Fines

What does this mean for you? Download this chart to find out!

DownloadChecklist: Buying a New Stretch Wrapper

Run through the important safety, useability, reliability and effectiveness aspects of buying a new stretch wrapper with this checklist.

DownloadChart: Containment Force Recommendations

Your pallets face a rough ride as they ship to your customers. How they look when they arrive is an important part of your brand. Make sure they’re wrapped tight enough to survive the trip by checking their containment force.

DownloadQuizzes

Which Semi-Automatic Stretch Wrapper is right for you?

Take our short quiz to find out. Based on your answers, you will receive a suggestion as to which stretch wrapper would best suit your needs.

What kind of Case Erector fits your needs?

This short quiz can help you identify the type of case erecting machine that would work best for your facility.

Which Tray Erector best suits your situation?

Looking to optimize your tray erecting process? Take this short quiz to see the recommended tray erector machine to fit your needs.

Hotmelt versus tape calculator

Find out your payback period for choosing Hotmelt closure instead of Tape […]

Tray productivity calculator

Manually erecting trays takes time, adds labor costs, and can slow down […]

Case savings calculator

If you’ve been considering a case erector for your production line, here […]